Onit Microfinance Bank

My Role: Lead Designer, Growth.

Lead the design of trust-building experiences and viral growth mechanics to drive app adoption and retention.

Team: Cross-functional team. 2 designers, 4 product managers, 8 engineers, and operations team building for iOS, Android and USSD

The objective:

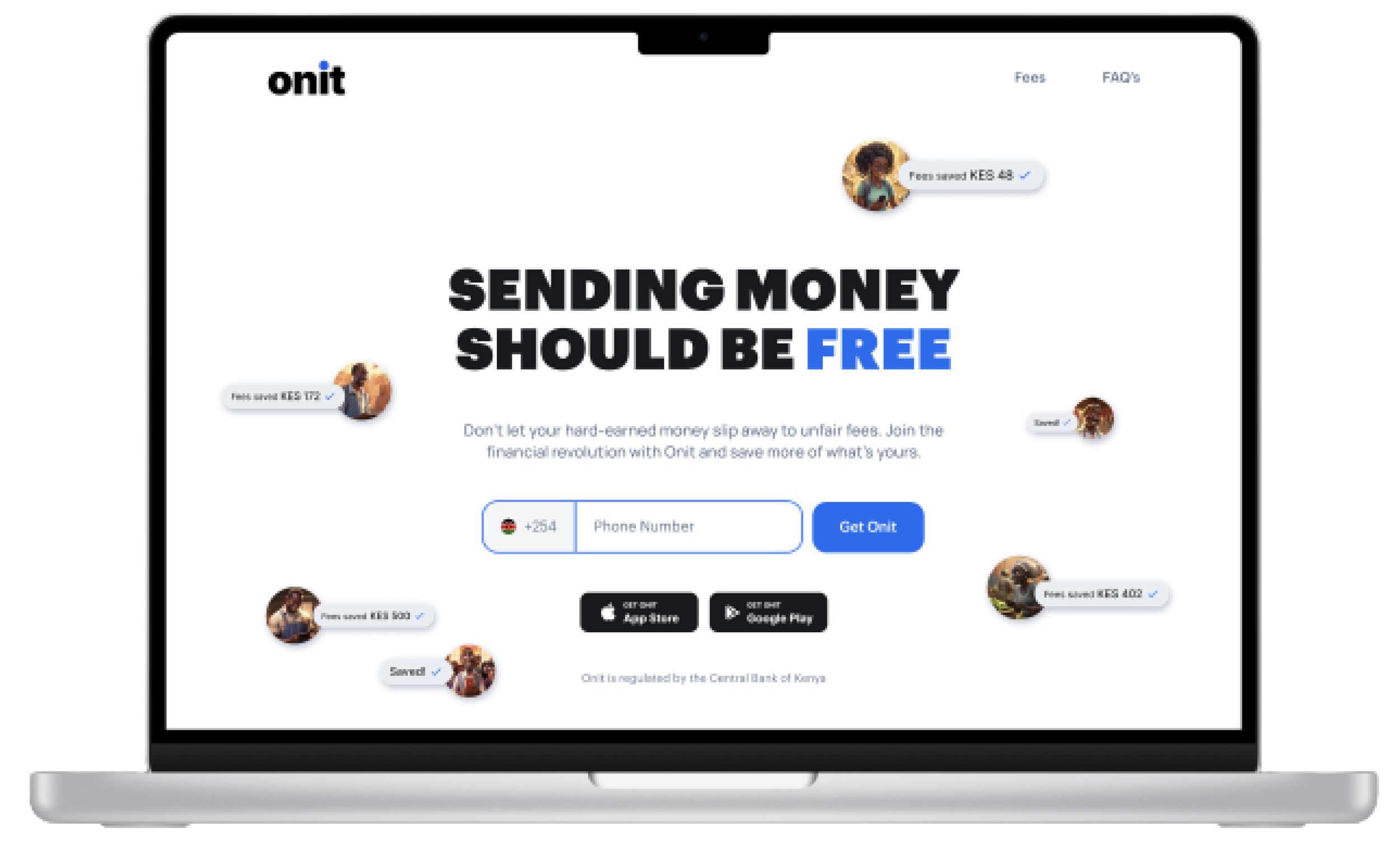

Banking is broken: Launch a zero-fee digital bank

Build trust in a price-sensitive, competitive market

Achieve growth without high marketing budgets

Seamlessly migrate credit users to the banking platform

Mapping constraints:

Business Constraints

❌ Limited marketing budget

❌ Skewed existing user base primarily expecting loans

❌ Needed to achieve viral growth (CAC had to be near zero)

❌ Tight timeline: 6 months to launch

Technical & Regulatory Constraints

❌ Integration with existing banking infrastructure/ processes

KYC regulatory requirements

Consumer protection disclosures (transparent pricing, T&Cs, data protection, real time transaction notifications & receipts)

❌ Real-time transaction processing limits

❌ Intermittent connectivity

❌ Low-end Android devices + feature phones

User Constraints

❌ Distrust of "free" financial products

❌ M-Pesa behavioral lock

❌ Very high Day 7 and Day 30 churn norms in market

❌ Low digital literacy

How do you build trust and drive viral adoption when users are skeptical, locked into a competitor's network, and you have limited resources?

The Problem

Kenya's 2.4M SMEs face an expensive & fragmented banking system.

M-Pesa charges 1-3% per transaction and controls 95%+ of mobile money movement in Kenya. Traditional banks require $500+ minimum balances, and account opening takes weeks. This leaves 65% of SMEs to operate entirely in cash, losing an estimated $2B annually to inefficient financial establishments, limiting their ability to grow.

Key Finding: The Cash Trap SMEs relied heavily on cash transactions and informal lending networks, not by choice, but because:

Traditional banks had high fees and minimum balances

M-Pesa was expensive for business transactions

Informal networks (family, suppliers) filled the credit gap

What This Meant for Design: We couldn't just build "a better banking app"; we had to design for the entire ecosystem of relationships: how merchants pay suppliers, how they collect from customers, how they access credit, and how they build trust in a new system.

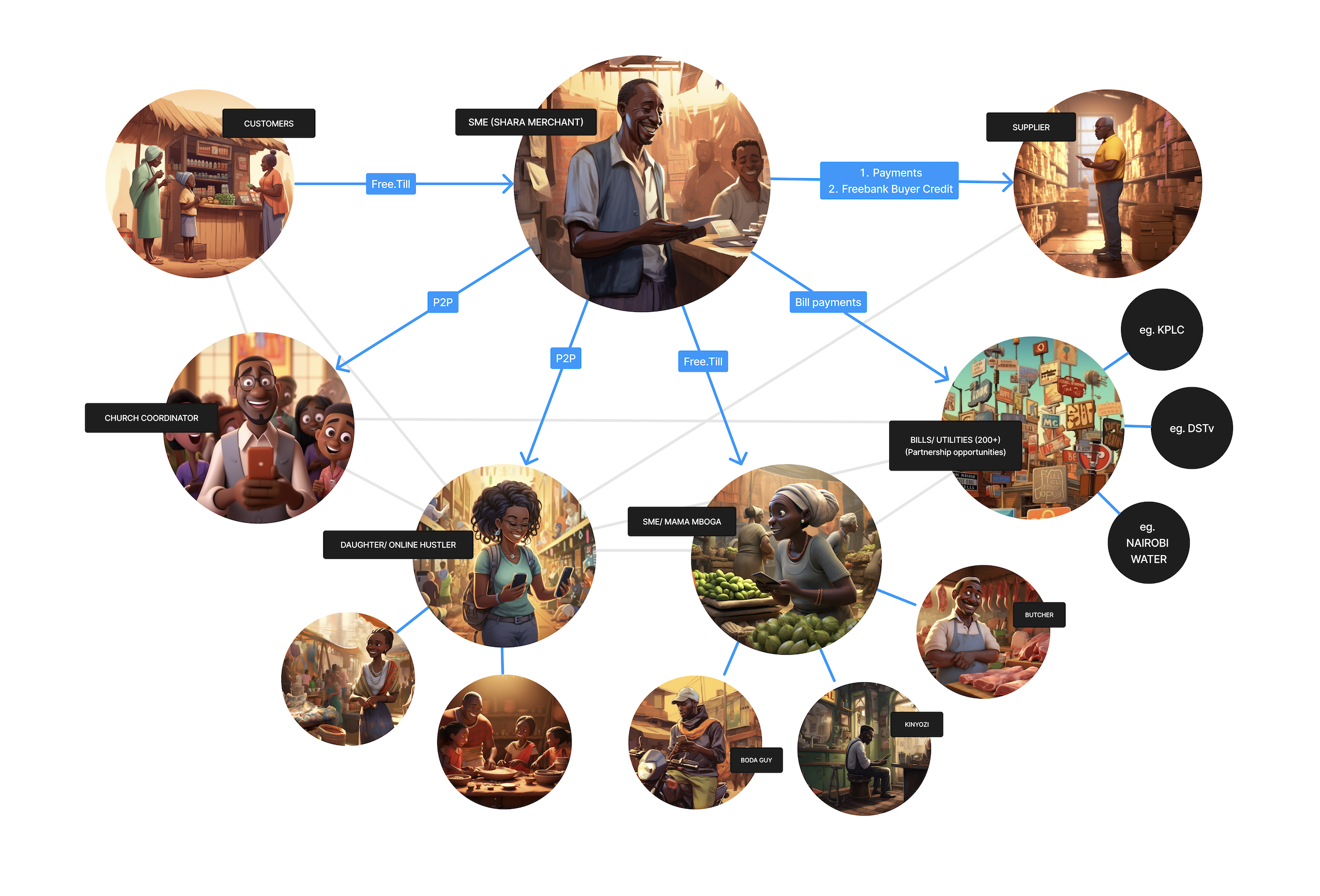

The Onit Ecosytem

To design the right solution, I needed to understand how money actually flowed through the economy. We studied the broader financial ecosystem in Africa, focusing on how SMEs interact with consumers, suppliers, and financial institutions. Our findings indicated that SMEs often rely on cash transactions and informal lending networks due to the inefficiencies and high costs associated with traditional banking.

SMEs weren't avoiding digital finance because they didn't understand it, they were rationally opting out of systems that didn't serve them.

I created this Onit Persona diagram to explain the ecosystem’s interconnectedness to the Product, Engineering and Design Teams.

*Image created using Midjourney and FigJam

Research & Design Process

Phase 1: Deep User Research

Conducted 40+ interviews with SME owners across 3 cities

Synthesized insights from 1,000+ survey responses with the lead product manager

Key findings: Users didn't trust "free" but were desperate to save money

Users had no idea how much they were spending on M-Pesa fees month on month

Phase 2: Constraint Mapping

Mapped regulatory requirements vs. user friction for KYC flows

Identified viral mechanics used by successful products (Monzo, Chipper Cash, Cash App, NCBA)

Defined north star metric: Viral coefficient K>1

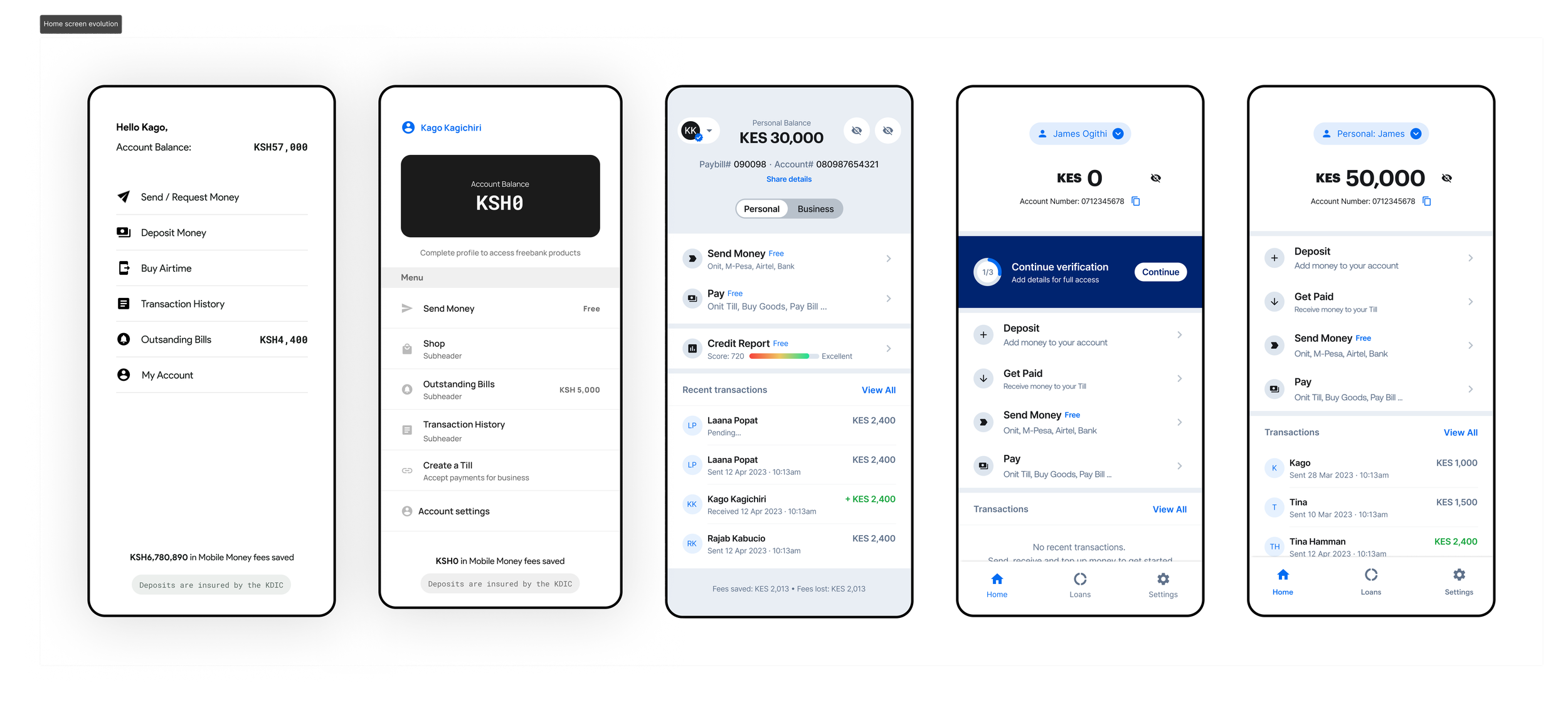

Phase 3: Rapid Prototyping & Design Iterations

Created 5 different approaches to communicating "free"/ cost savings

Tested trust-building elements with dedicated focus groups

Iterated on referral flow designs (tested 2 variations)

Phase 4: Constraint-Driven Design Decisions

Made key trade-offs (detailed next)

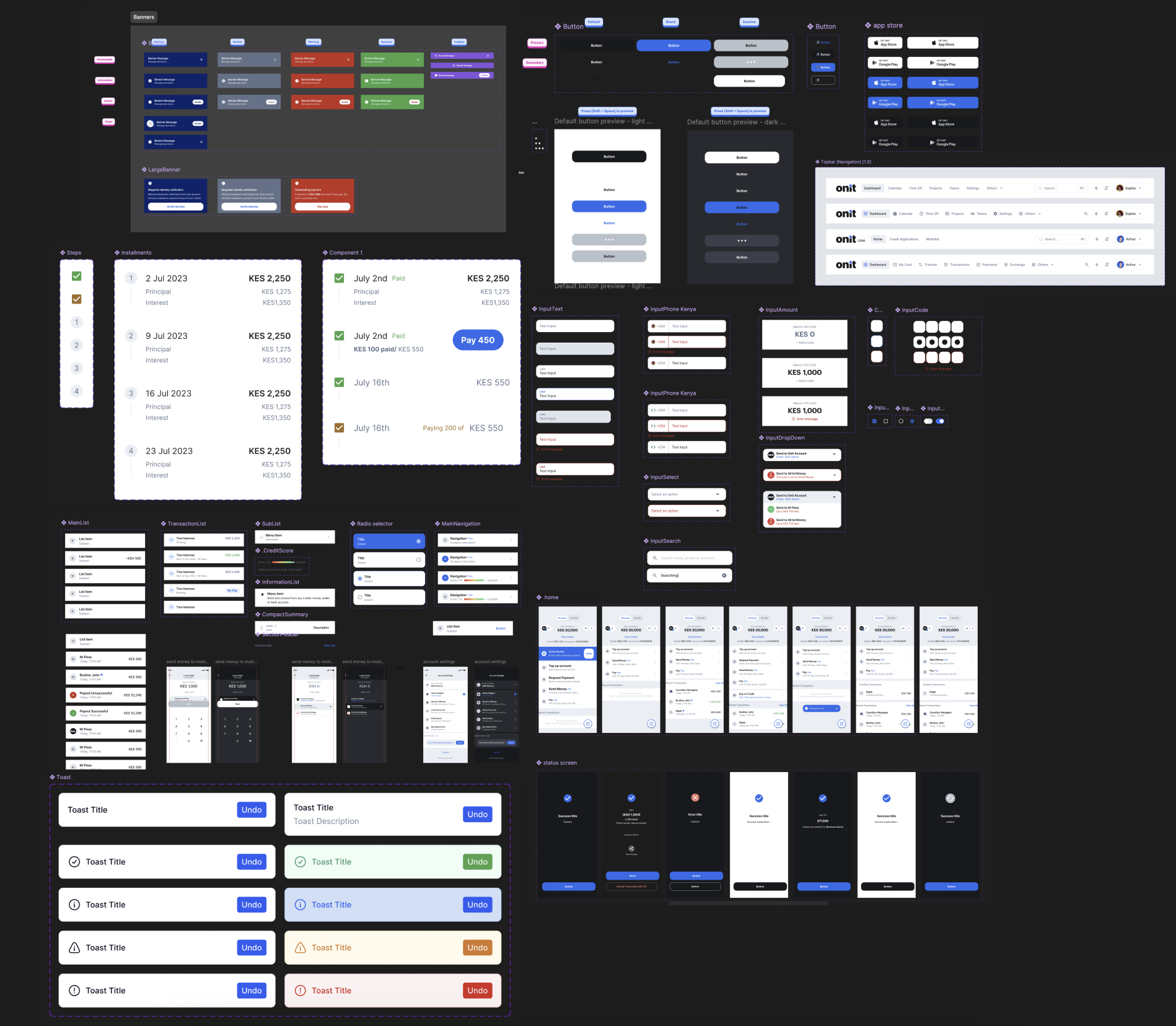

Built design system for velocity

Prepared for beta launch

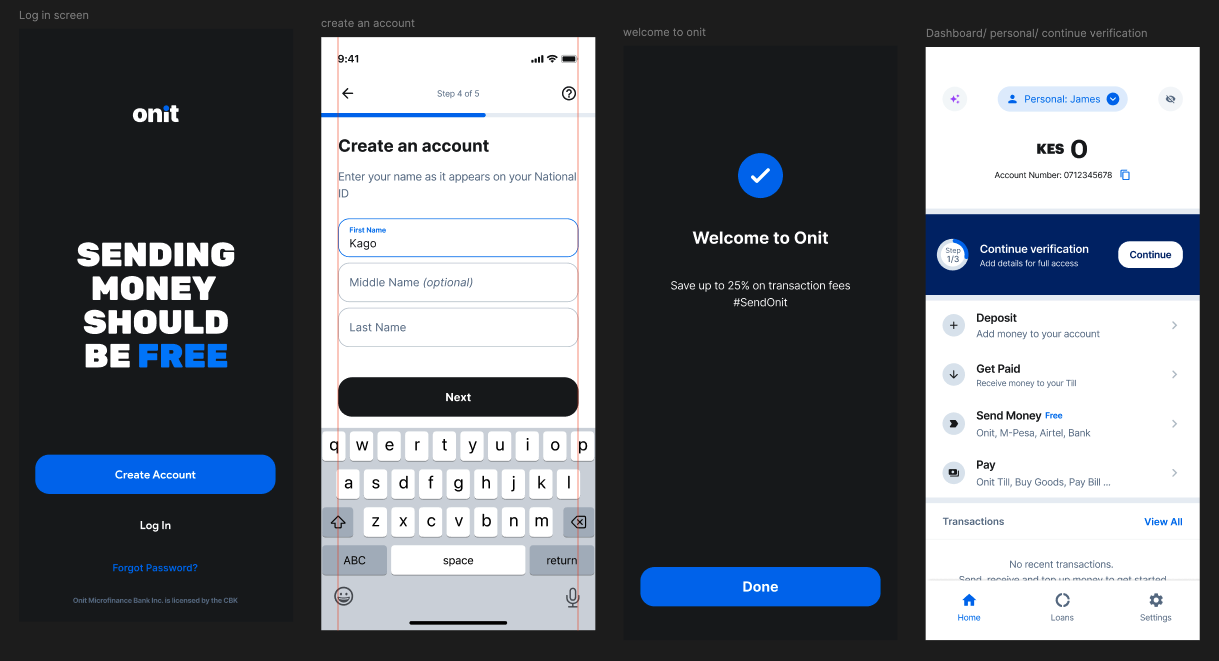

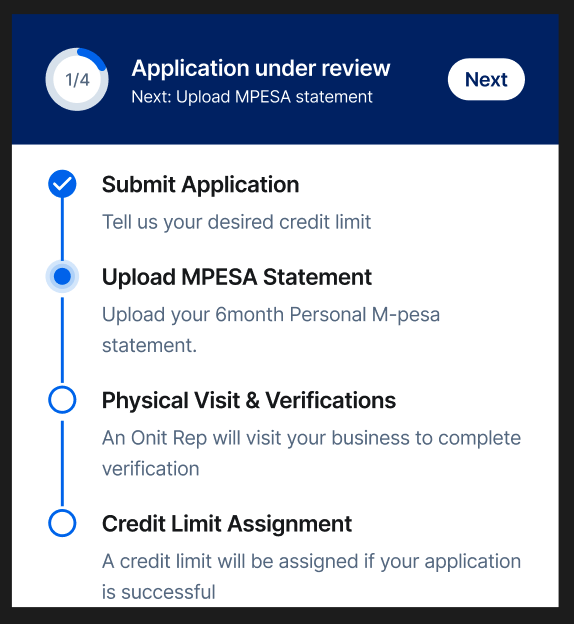

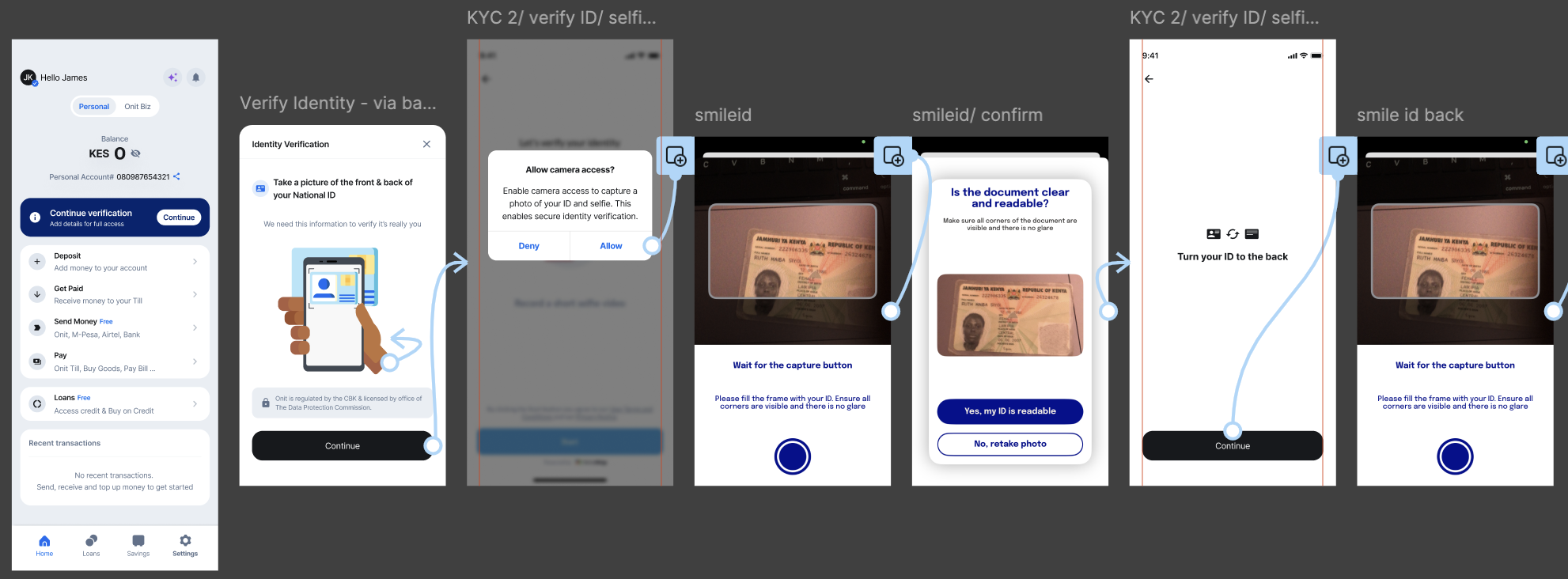

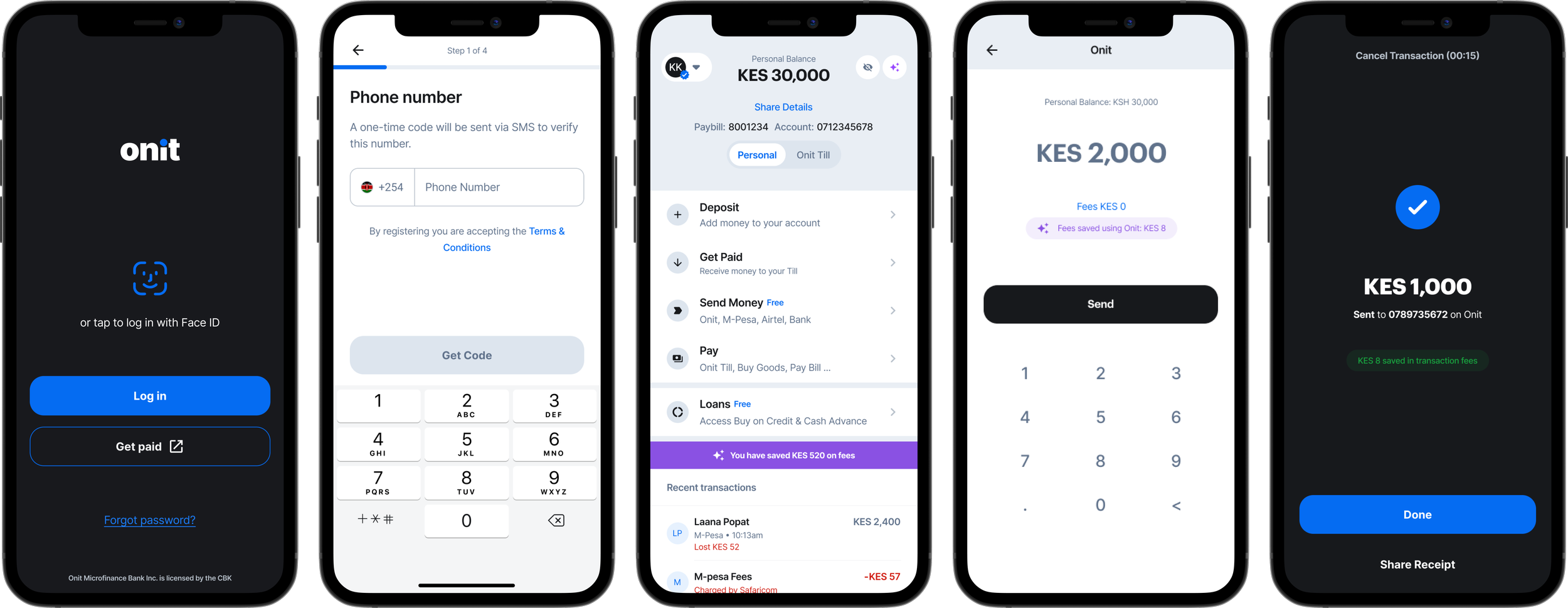

Designing Tiered KYC

The Constraint Conflict:

Regulatory requirement: Full KYC before account access

User need: Immediate value or high drop off

Business need: High completion rates

Key learnings from protyping:

Users dropped off almost immediately if too much sensitive financial info was asked for outright - no ID’s in hand, no KRA pin, bad lighting for KYC selfies etc…

Options:

Full KYC = regulatory compliant but 27 steps to full completion meant high drop-off rates, killing activation metrics

No KYC = Instant access, great KYC but non-compliant

Tiered KYC = Balanced approach with more techincal complexity*

*KYC 2: SmileID integration to reduce enginneering lift

Decision: Tiered KYC for MVP

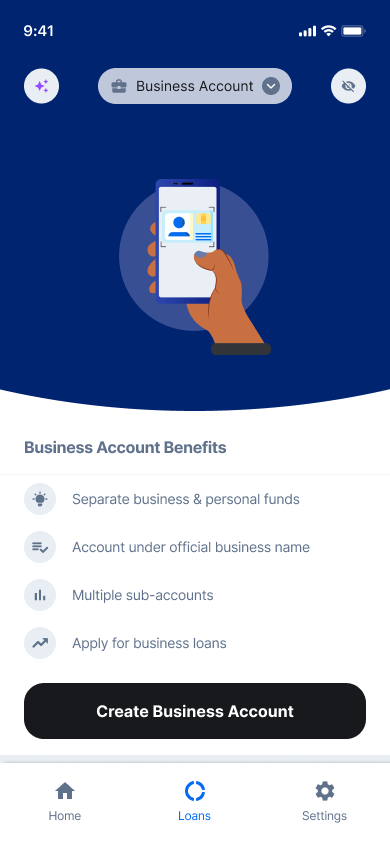

Created "first basic account" with transaction limits

Users could add/ send small amounts immediately

Progressive verification unlocked higher limits and business features

Clear communication about what they could do now vs. later with business accounts

The trade-offs

✅ Immediate value → reduced early churn

❌ More complex system to build (engineering push-back)

Multiple account states instead of one (for credit users as well)

Transaction limits had to be enforced dynamically

More complex testing, monitoring, and support tooling

Why it mattered

We turned KYC from a blocker into a retention lever. Something that unlocked value instead of blocking users.

Impact:

Users who completed Tier 1 had 3× higher Day 7 retention than those forced into full KYC upfront because they gained trust as they learned more about the product.

#2: Designing for Trust and Transparency

Constraints:

Business model: Zero fees

User skepticism: "Free" seemed too good to be true

Need to differentiate: M-Pesa was familiar (even if expensive)

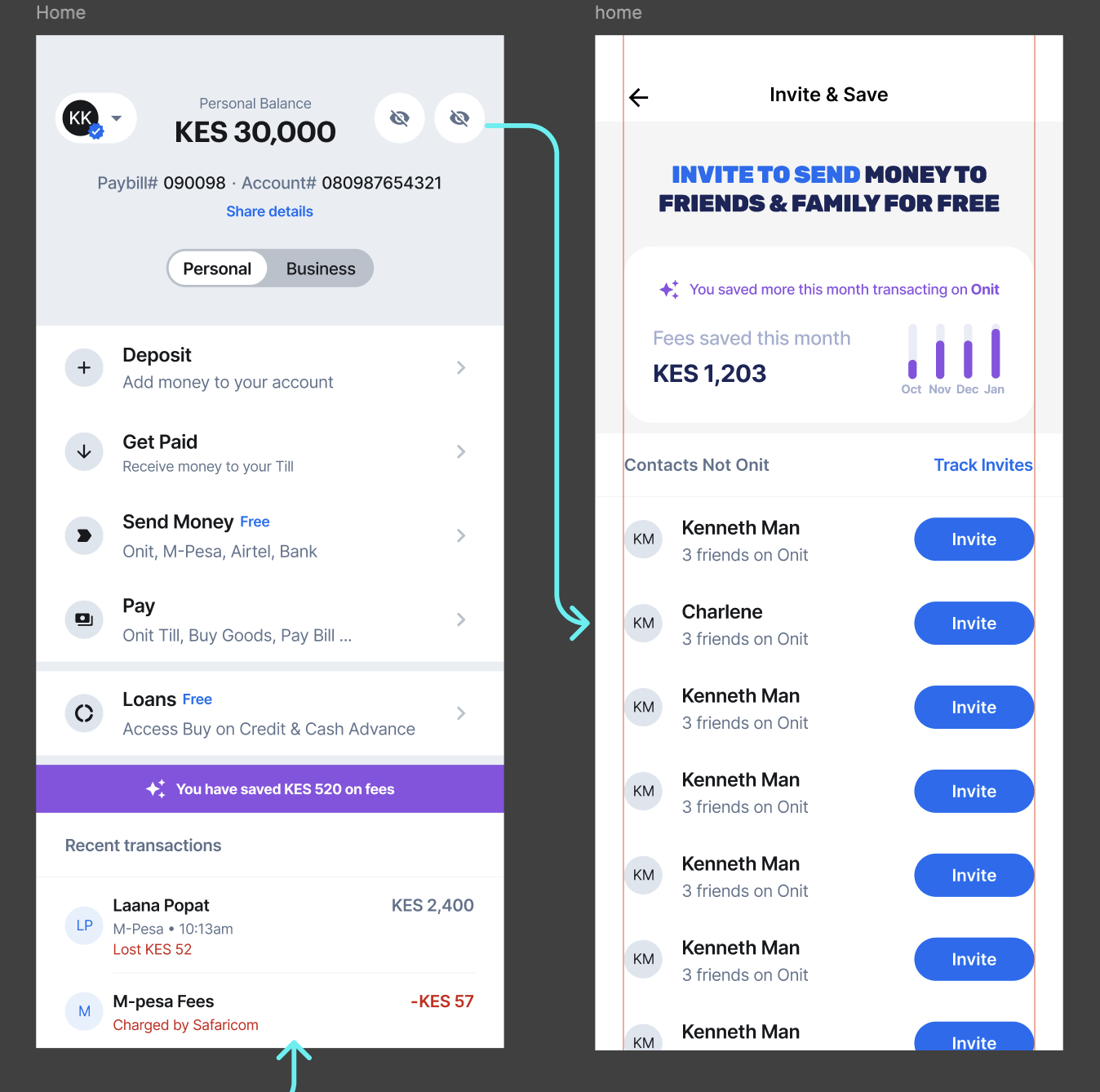

My designs to explore different approaches to communicating "free"/ cost saving on transactions

Design Decision: Show, Don't Tell

Designed real-time cost comparison: "Lose KES45 on M-Pesa fees. Send for KES 0 Onit.

Created a running "total saved" counter dashboard

Made fee comparisons on transactions visible and simple

Later: Test social proof: "Your friend Jane saved KES 450 this month"

The Trade-offs:

Created competitive differentiation

Required complex calculations in real-time

Why It Worked: Users needed proof, not promises. Showing real time savings built trust faster than any marketing message.

Impact: By making fees visible and transparent, we reduced friction to first transaction, increased early retention, and unlocked organic growth.

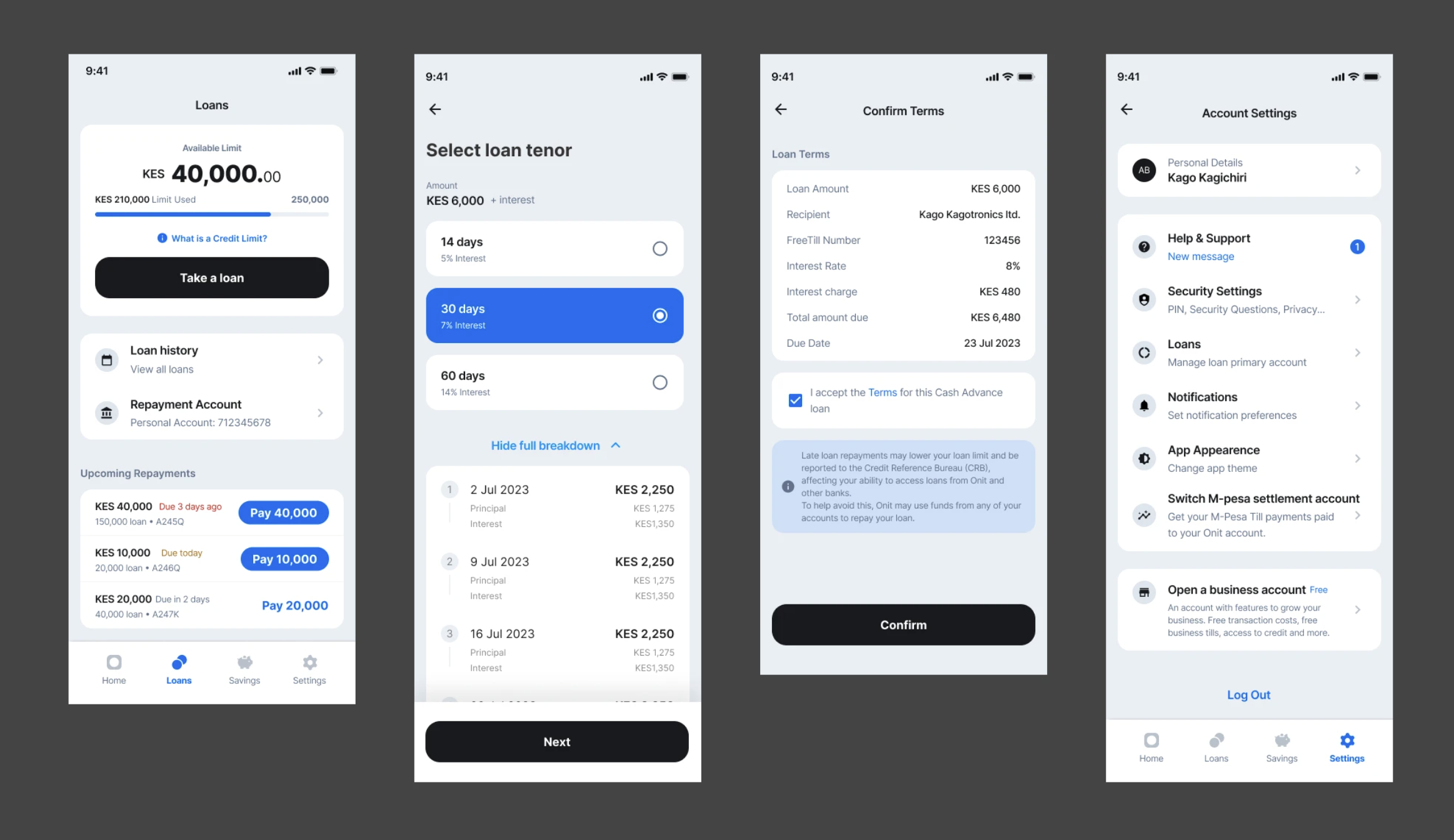

#3: Banking & Credit Designed to Help Businesses Grow

Once trust and usage were established, the real opportunity was to design banking around how businesses actually grow, not around consumer lending models.

Constraints:

SMEs punished by off-rails mobile money fees

Credit products were predatory and disconnected from business performance

Cash-flow volatility was the real painpoint, not credit appetite

Why it mattered: We designed credit based on how the business actually operates. We built credit scoring models that analyzed merchants M-pesa statements to provide limits based on transaction volume

Customers can pay the merchant for free

Reduced cash handling risk

Clear transaction records

Easier reconciliation and proof of income

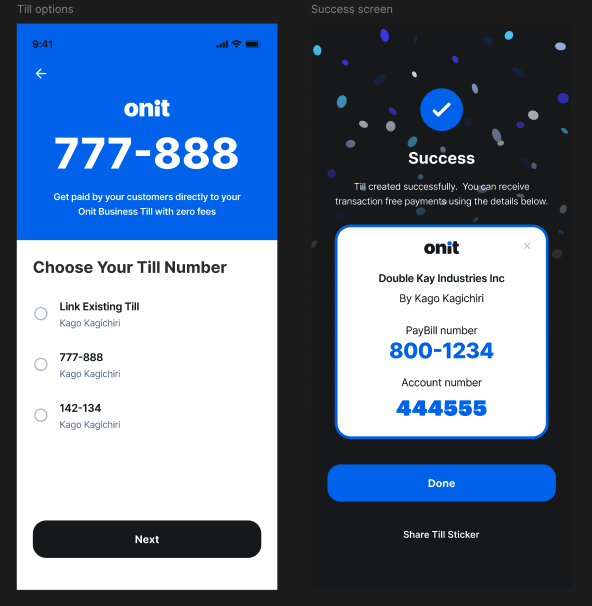

#SendOnit

#GetOnit

#SaveOnit

#SendOnit #GetOnit #SaveOnit

Learnings

In a competitive financial market, we believe it was important to:

Reduce the complexity of account opening

Show immediate value and gain users’ trust

Then layer business-first banking and credit features to give our users a reason to stay and grow.

Other initiatives I worked on

Design system documentation to increase design velocity and handoff with engineers

Notifications for upcoming payments and available payment options

Branding and product marketing.

Education modules explaining digital banking fundamentals for first-time users

Payment links to request payments for offrails users.

Sales agent app for our field team to monitor and manage leads.

and many more…